The act gives the Board authority

to make improvements in the check-collection and -return systems in

order to shorten the time within which depositary banks learn of the

nonpayment of checks, and thereby reduce the number of situations

when the bank will be required by law to make funds available to its

customers before it learns a check has been dishonored. The Board’s

authority is broad and general and extends to checks that are not

cleared through the Federal Reserve System. Previously, the Federal

Reserve generally had the authority to regulate only those checks

it collected.

9-747

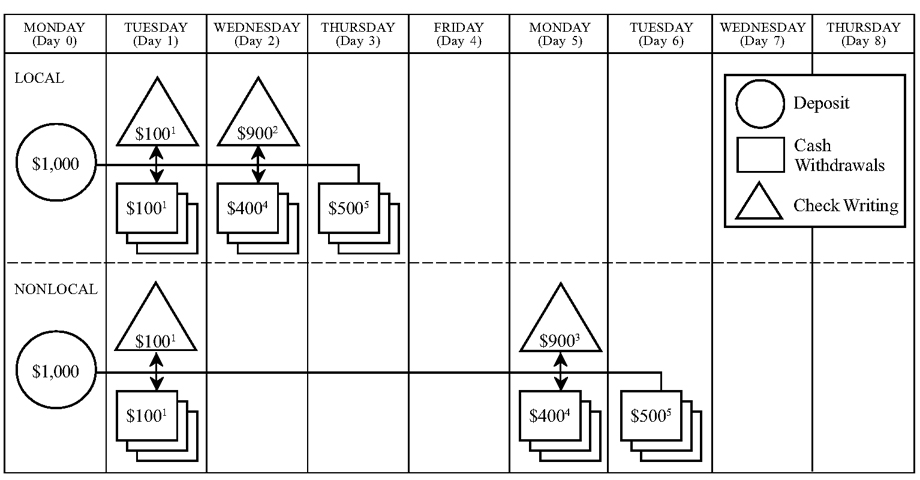

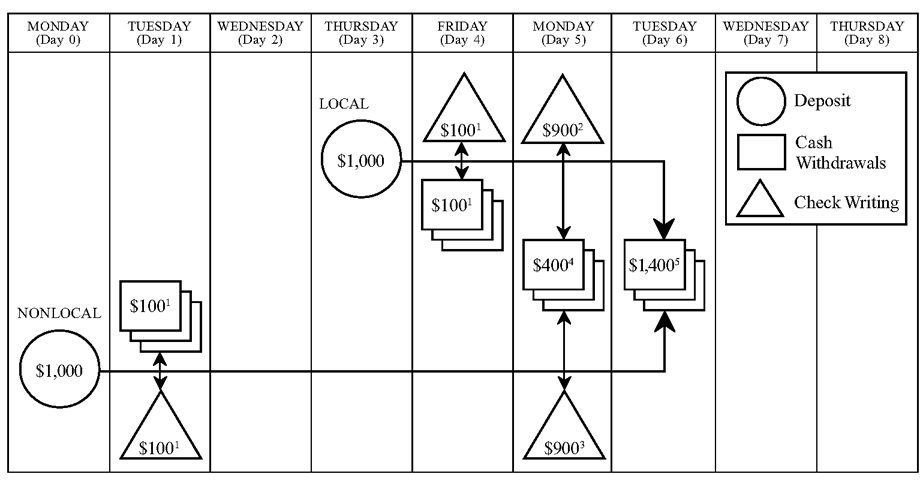

The Paying Bank Section 229.30 of Regulation CC requires that the

process of returning be accomplished in an “expeditious manner,” thus

requiring the paying bank to take steps to speed the flow of returned

checks. The paying bank must dispatch returned checks with the same

speed and diligence with which it would dispatch forward-collection

checks received for deposit by noon on the banking day after the day

of presentment of the returned check. This means that a check presented

to the paying bank on Monday that is not paid must be dispatched as

quickly as a check deposited in that bank on Tuesday morning that

is drawn on the depositary bank. A paying bank also returns a check

expeditiously under the new rules if it returns a local check to the

depositary bank within two business days of presentment, or a nonlocal

check within four business days of presentment.

Paying banks may dispatch returns by the same

manner, and at the same time, as they send forward-collection checks.

This will usually mean that returns will be sent via courier rather

than mail. The paying bank is required to meet the deposit deadlines

and sorting requirements set by any returning bank to which the returned

check is sent.

A paying bank could return all checks to a single returning

bank rather than sending them to multiple presenting banks. Paying

banks can return checks to the depositary bank or to a bank agreeing

to process returns, including the Federal Reserve. If the paying bank

cannot identify the depositary bank from the indorsement, it may find

it necessary to send that returned check back to the presenting bank.

Paying banks have the option to prepare a returned check

for automated processing by high-speed equipment. The bank can produce

a qualified returned check (QRC) by enclosing a returned check in

a carrier envelope or attaching a strip to the bottom of the check,

and encoding the carrier or strip with the nine-digit routing number

of the depositary bank, a special returned check identifier, and the

amount of the check. By creating QRCs, the paying bank facilitates

expeditious return of the check to the depositary bank. Preparation

of QRCs by paying banks also reduces the cost of the overall return

process because returning banks will be able to handle these checks

more efficiently.

Paying banks are required to provide notice of nonpayment

on all returned checks of $2,500 or more, regardless of the channel

of collection. Notices will have to be received by the depositary

bank by 4:00 p.m. (local time) on the second business day following presentment

of a check to the paying bank. This means that if a decision is made

to return a check of $2,500 or more that was presented on Monday,

the paying bank must ensure that the notice is received by the depositary

bank no later than 4:00 p.m. Wednesday.

9-748

Returning Banks Regulation CC holds

returning banks to a standard similar to paying banks. Returning banks

must handle returned checks in an “expeditious manner”; that is, returned

checks must be processed and dispatched in the same general manner

as forward-collection checks or returned to the depositary bank within

the two-day/four-day time period established for paying banks. Returning

banks may return a check directly to the depositary bank or to another

returning bank as long as the route chosen for the return is expeditious.

Returning banks have the option to convert returns to

QRCs. If a returning bank chooses to prepare a QRC, it may take a

day to do so beyond the time when the check would otherwise have been

dispatched. An extra day is not available when returning directly

to the depositary bank, because preparation of a QRC would not speed

such returns.

9-749

The Depositary Bank Regulation CC requires that the depositary bank place

a standard, complete, legible indorsement on the check. This will

help paying and returning banks identify the depositary bank and,

therefore, process the return promptly. Some banks may have corporate

customers that encode checks prior to deposit and place the depositary

bank’s indorsement on the check according to the new standard. Some

small depositary banks may have their correspondent place its indorsement

on the check as the depositary bank endorsement. Failure to follow

the indorsement standard may reduce the right of the depository bank

to recover a loss incurred because of the untimely return of a check

from the bank that delayed the return, if the delay is due to a nonstandard

indorsement.

Depositary banks must pay, in same-day funds, for returned

checks on the day the checks are received. If paying banks and returning

banks that return checks directly do not wish to receive same-day

payment by wire transfer, cash, or Federal Reserve net settlement,

or if the paying or returning bank does not maintain an account relationship

with the depositary bank, the banks may agree on the form of payment,

which may be a check or an ACH payment.

Under the new check-return rules, depositary banks will

receive returned checks and notices of nonpayment earlier and will

receive notices of nonpayment on all large-dollar returned checks,

instead of only those checks which were collected through the Federal

Reserve.